gaming business

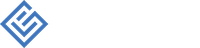

As you might remember at one time, Curaçao was the undisputed leader in global iGaming licensing. Before 2023, it accounted for nearly 85% of the market, an amazing dominance.

You would be surprised to know that at this day, only around 300 Curaçao-licensed operators remain. In contrast, Anjouan has already surpassed 900 licensed companies about to cross 1,000.

We're a team with over 15 years of experience in gaming regulation across multiple jurisdictions, and we’ve guided more than 500 gaming companies through licensing processes worldwide. And can see a clear trend: the smart startup money is moving to Anjouan, and for good reason.

The Offshore Gaming License Landscape in 2025

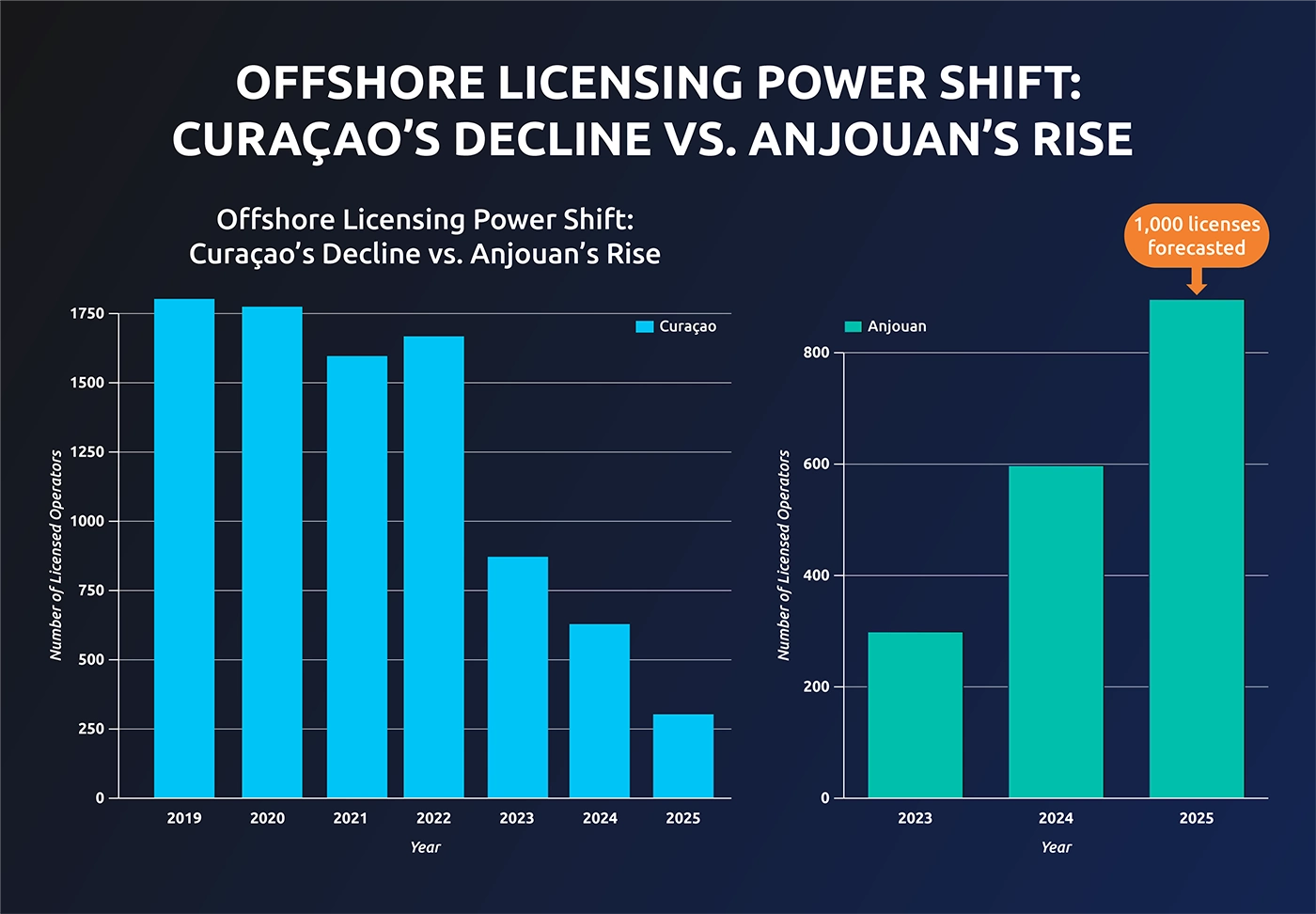

Since Curaçao announced its sweeping regulatory overhaul in 2023, changes have now crystallized into a completely different licensing system that has fundamentally altered the offshore gaming landscape.

As many operators built their businesses on Curaçao's previously accessible framework, they now find themselves facing increased compliance burdens, longer processing times, and significantly higher costs. The promised "improved reputation" for Curaçao licenses hasn't materialized as quickly as the fee increases have.

Meanwhile, Anjouan has quietly established itself as the go-to alternative, offering what Curaçao used to: a streamlined, cost-effective licensing solution with minimal bureaucracy and for startups and established operators alike, this value proposition is becoming impossible to ignore.

Anjouan vs Curaçao: Side-by-Side Comparison

Let's cut straight to what matters most to your business. Here's how these two offshore licensing options truly compare in 2025:

Parameter | Curaçao License | |

Initial License Cost | €17,000 total. A-Z setup may cost between €32,900 and €41,300 | €25,000+ €25,000 government fee + €5,000 application + other mandatory costs. First year A-Z setup may reach €100,000 and more. |

Processing Time | 4-6 weeks | 6-12 weeks (A-Z process can take 8 months and longer) |

Tax on Gross Gaming Revenue | 0% | 0% |

Licensing Structure | Separate B2B and B2C licenses required | Separate B2B and B2C licenses required |

Company Requirements | Can operate through any offshore company | Must establish local Curaçao company |

Local Presence | Not required | Minimum 2 key staff on island (local substance requirements) |

Compliance Burden | Focused on AML/KYC fundamentals | Extensive ongoing compliance requirements |

Audit Requirements | Basic third-party system checks | Mandatory regular audits |

License Coverage | All gambling activities under one license | All gambling activities under one license |

Renewal Process | Simple annual renewal | Complex renewal with increased scrutiny |

For a typical mid-sized operator, as maybe it is your case, switching from Curaçao to Anjouan represents an immediate savings of approximately €60,000 in the first year alone when factoring in license fees, compliance costs, corporate structure and tax obligations.

Over five years? You're looking at savings of €300,000+ that could be reinvested into your marketing, product development, or simply kept as an improved profit margin.

Guess what’s more important than money? Time.

While your Curaçao application sits in a regulatory queue for months, your Anjouan-licensed competitor is already live and capturing market share, covering its business expenses from actual revenue (and not paying salaries out of pocket).

Let’s Make It Work for You

If you’re launching a gaming brand (or looking to exit the slow lane Curaçao has become) we can help.

- Proven track record of Curaçao to Anjouan transitions

- Support with licensing, structuring, compliance, and payment setup

- A clear, personalized strategy to get you live faster and for less

Regulatory Stability: The Hidden Advantage

Beyond the obvious cost and time benefits, Anjouan offers something that has become increasingly precious in the iGaming sector: regulatory stability.

Since establishing its gaming framework in 2005 under the Computer Gaming Licensing Act 007, Anjouan has maintained a consistent regulatory approach. Even after issuing over 900 licenses by 2023, Anjouan hasn’t shifted its strategy (while Curaçao is now down to just around 300 licensed companies).

In contrast, Curaçao's regulatory landscape has been in constant flux. The latest overhaul represents the most significant change yet, with operators facing:

- Unpredictable implementation timelines for new requirements

- Evolving compliance standards that require constant adaptation

- Uncertainty around future regulatory changes as the new Gaming Control Board establishes itself

- Additional staff requirements that can be difficult to fulfill given the limited talent pool on the island

Curaçao also has a habit of rebranding, changing pricing strategies, tweaking how they invoice companies - and slipping in unpleasant surprises after payments are made.

And what about the messages sent to operators who kept their company in Curaçao but decided to get licensed in Anjouan? Now they’re being told these setups are “illegal.” (Not exactly the best way to attract more business.)

According to our inside sources, Curaçao is planning even more regulatory changes for Q3 2025, likely to include increased capital requirements and expanded personal liability for directors. This perpetual state of regulatory uncertainty makes business planning extremely difficult.

Meanwhile, Anjouan has been remarkably consistent, with only minor updates to its AML frameworks and release of a separate B2B license in the past three years.

This simple difference allows businesses to focus on growth rather than constantly adapting to regulatory shifts.

Player Protection Requirements

Parameter | Anjouan | Curaçao | Advantage |

Responsible Gaming Tools | Basic self-exclusion requirements | Comprehensive responsible gaming framework | Curaçao |

Player Fund Protection | Standard segregation requirements | Enhanced fund segregation and protection | Curaçao |

Dispute Resolution Mechanism | Basic complaint procedures | Formalized dispute resolution system | Curaçao |

Player Data Protection | Standard data protection measures | Enhanced data protection framework | Curaçao |

Addiction Prevention Tools | Minimal requirements | Comprehensive prevention tools required | Curaçao |

Marketing Restrictions | Limited restrictions | Comprehensive advertising standards | Anjouan |

Player protection is where Curaçao wins (and will likely keep winning) as it continues to develop its responsible gaming framework.

But here’s the real question: What mechanisms are in place to pursue fraudulent activity by business owners beyond simply canceling a license? And how is that any different from losing an Anjouan license for the same reason?

This question remains unanswered. Especially since none of the offshore licenses require substantial working capital or any kind of insurance to cover player losses if things go wrong.

The logic still holds: serious businesses won’t cheat their players, regardless of whether they’re licensed in Anjouan or Curaçao, simply because reputation is everything.

Crooks get exposed quickly in this industry, and stories about shady online casinos spread fast, just like the infamous scandals from the Las Vegas Strip.

Market Access Comparison

Parameter | Anjouan | Curaçao | Advantage |

Restricted Territories | 9+ major markets + FATF blacklisted | 8+ major markets + FATF blacklisted | Anjouan |

EU Market Perception | Lower recognition | Lower recognition | Tie |

Asia-Pacific Market Access | Excellent coverage | Excellent coverage | Tie |

Latin American Market Access | Excellent coverage | Excellent coverage | Tie |

African Market Access | Good coverage | Good coverage | Tie |

Market Expansion Flexibility | High - minimal procedural changes | High - minimal procedural changes. Possible complications in the future | Anjouan |

Both licenses offer nearly identical market access, with restrictions applying to the same set of countries.

What you can do with a Curaçao license, you can just as easily do with Anjouan.

Including integrating payment providers. No exceptions.

The only real uncertainty lies with Curaçao: will it stay on its current path, or start restricting more markets now that it’s aligning with European-style compliance and regulation? Only time will tell.

Case Study: BC.Game’s Public Departure

One of the earliest adopters of Curaçao’s new licensing model was BC.Game - a major name in the industry. But shortly after receiving their license, things fell apart.

Their company in Curaçao was shut down. BC.Game publicly called it a “hostile jurisdiction” and switched to Anjouan, never looking back.

This wasn’t an isolated case - 150+ former Curaçao operators are now licensed in Anjouan.

Case Study: Speed Over Bureaucracy

Just two months ago, a team approached us after waiting over 5 months for their Curaçao license, with no end in sight. They had a full team on payroll, monthly burn in the hundreds of thousands, and no operational green light.

We helped them switch gears and secure an Anjouan license. Once documentation was prepared, the license was issued in under two weeks.

That’s the key difference: for companies with real expenses and real pressure, speed becomes a matter of survival.

The Truth About Banking & Processing

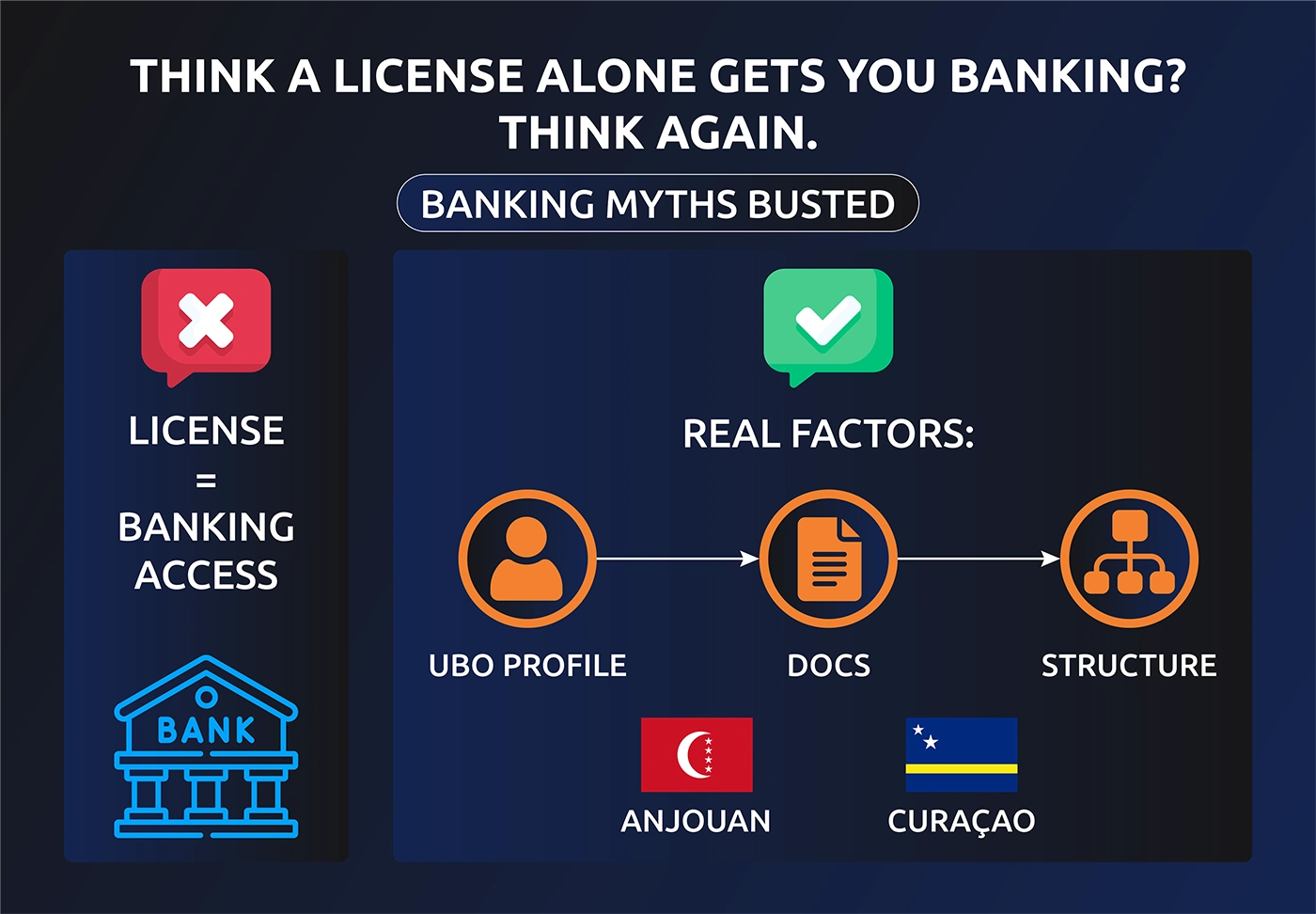

Contrary to common assumptions, your ability to open a bank account or payment gateway does not depend on your license! it depends on your company structure, documentation quality, and the UBO’s profile.

We are opening banking accounts for both Curaçao and Anjouan structures and the success rate is practically identical.

I think there’s a valuable lesson here: if you don’t adapt to the market, your business will be left behind (and your competitors will gladly take your place).

We saw the same thing unfold in the banking sector. It took the market about six months to fully recognize that Anjouan had emerged as the new leader in international gaming licenses. Those who moved early are now operating.

Expert Insights: Why Anjouan is Winning the Offshore License Race

Having consulted with gaming regulators across multiple jurisdictions, I've gained some valuable insights into why Anjouan has emerged as the preferred choice for forward-thinking operators in 2025:

- Regulatory Philosophy Difference: Curaçao's new framework attempts to position itself as a "premium" jurisdiction, but it's caught in an identity crisis - not quite at the level of Malta or Isle of Man, yet significantly more burdensome than its previous iteration. Anjouan, meanwhile, has embraced its role as a business-friendly jurisdiction focused on essential safeguards without unnecessary red tape.

- Market Recognition Reality: While Curaçao promised improved market recognition with its new framework, the reality has been different. Game providers, payment processors, and affiliate networks have rapidly adapted to accept Anjouan licensing with the same level of recognition previously afforded to Curaçao. The market has spoken: Anjouan licenses are now widely accepted throughout the industry.

- Operational Practicality: Curaçao's requirement for local staff has proven particularly problematic. Finding qualified gaming professionals willing to relocate to Curaçao has been challenging, and the costs associated with maintaining this physical presence are substantial. Anjouan's more flexible approach eliminates this artificial barrier to entry.

- Future Regulatory Direction: My discussions with a regulator suggest that Anjouan is committed to maintaining its competitive advantage as a business-friendly jurisdiction while making targeted improvements to its AML framework. This balanced approach stands in contrast to Curaçao's more unpredictable regulatory trajectory.

Conclusion: Choosing the License That Matches Your Business Goals

Curaçao has undeniably improved from a regulatory standpoint. It now offers more robust compliance, better governance, and a stronger focus on player protection.

From the government’s perspective, this is a win but from a business perspective, especially if you’re launching or scaling an online casino, it’s a different story.

Stricter regulations, longer timelines, and higher overhead mean Curaçao is no longer the go-to license for operators who care about speed, cost-efficiency, and operational flexibility.

Anjouan, on the other hand, has quickly become the offshore license of choice for forward-thinking operators. The numbers speak for themselves: over 900 licensed companies in less than two years, many of them ex-Curaçao operators who didn’t want to wait 6–8 months or pay €100,000+ per year to stay compliant with Curaçao’s new regime.

Having overseen more than 500 licensing projects, I’ve seen this shift firsthand. Operators who moved to Anjouan aren’t compromising on functionality - they’re gaining speed, reducing compliance headaches, and cutting their operating costs by six figures over just a few years.

This isn’t a debate about which license looks better on paper. It’s about what gets your business live, generates revenue faster, and allows your team to focus on growth - not bureaucracy.