How To Get a Malta Gambling License in 2024

Why would I need the Malta MGA license?

99 times out of 100, you will not get yourself a Malta gaming license.. This can be a wrong move if you’re a startup and have no revenue yet.

This is because the Maltese license is considered a Tier 1 license and has a completely different philosophy than the Curacao or Kahnawake license. It’s also considerably more expensive than any of these licenses.

Three great questions to ask before applying for a Maltese license:

1. How long have you been in business?

2. How many employees do you have, and what is their experience?

3. Do you have financial resources?

By answering these questions honestly, you can assess whether you’re ready for Tier 1 licensing.

The MGA is the primary regulatory body responsible for all gaming activities in Malta. It’s also responsible for preventing, detecting and combating criminal activity in the gambling sector.

Benefits of setting up a business in Malta. Is it worth it?

Malta was the first EU state to license online gambling and has the most experience in the various areas of iGaming.

As a result they’ve built an ecosystem with a whole range of services to establish and maintain iGaming licenses in Malta with top data centers, gaming-friendly banks and EMIs, friendly PSPs and the largest affiliate networks.

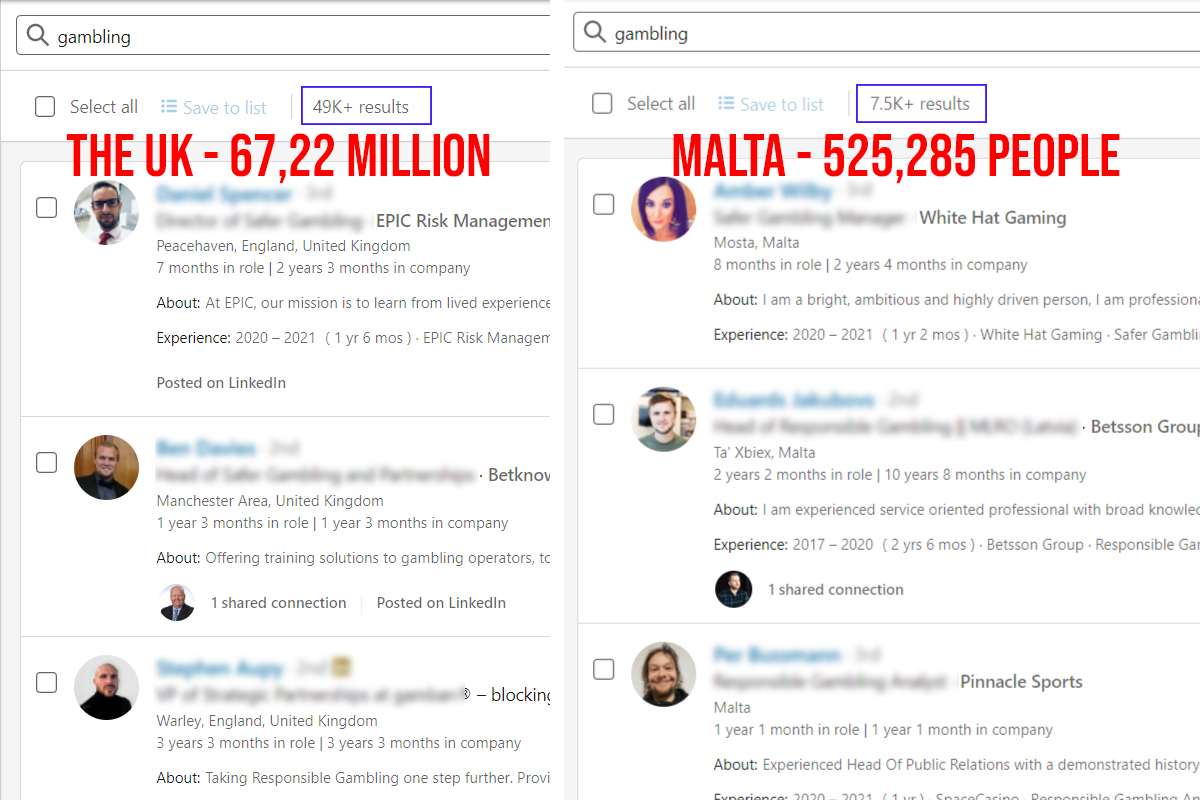

Malta has the highest number of gaming professionals per capita in the world.

If you search on LinkedIn for professionals using the term “gambling” you get 7.5k people based in Malta. Considering that Malta is home to just over five hundred thousand people, the density of professionals is enormous.

In the United Kingdom, there are 49,000 people out of a population of 67.22 million!

The real advantage is that the lowest corporate tax in the EU makes Malta an unbeatable location for any type of iGaming business.

In addition, Malta is only a 2-3 hour flight from all major capitals in Europe.

How is this different from a Curacao license?

When companies are looking for a license, they are usually looking for a way to connect PSPs, banks and software vendors in their chosen regions.

They want it fast, they want the process to be as simple as possible and as cheap as possible.

Such business owners do not ask too many questions about the best interests of their customers. Every day is a battle. When they win, they win. But when they lose, they still look for ways to leave customers with nothing.

When you get a Tier 2 or Tier 3 license, the only obstacle is passing the KYC (personal background check) and submitting a decent business plan.

You will most likely get the license if your background is decent and you have no criminal record. There will be no future financial audits or other mechanisms to hold you accountable over the financial year.

Malta Gambling Authority will work to make sure that your business is legit and healthy

The Online Casino Malta License is different. It wants to strike a balance between your rights and the rights of your clients. That is why it starts with the mindset first.

- You have to prove that you and your team are good enough to run such a business.

- You have to have capital.

- After you get your license, you will have to undergo various audits to prove that your business is healthy and that you have your clients’ best interests at heart.

Why not just take any other license and not worry about the MGA?

Reputation is the key

Great clients know that the Maltese license protects their best interests. They know they can win and get their money no matter what. Sharks will not even consider playing anywhere else unless the company has a Maltese, Isle of Man or any other Tier 1 license.

Investment opportunity

If you want to attract investment, quality of earnings helps investors determine the true value of your business. With the audits that MGA conducts on a regular basis, it’s easy to prove to your investors that your company is a good long-term investment.

Initial Public Offering

If you plan to go public, the only way is to get a Tier 1 license first.

Better Partnership opportunities

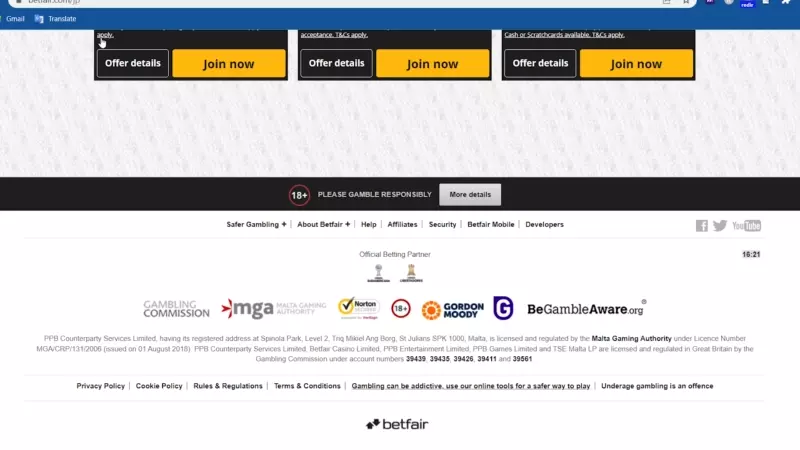

Although all top software providers work with Curacao license, some providers work only with Tier 1 licenses. A good example is the Betfair or any traditional bank – they’ll reject your application if you have only a Tier 2 license.

The same goes for payment system providers and banks. You can get top-notch deals if you have a Maltese license or the Isle of Man license.

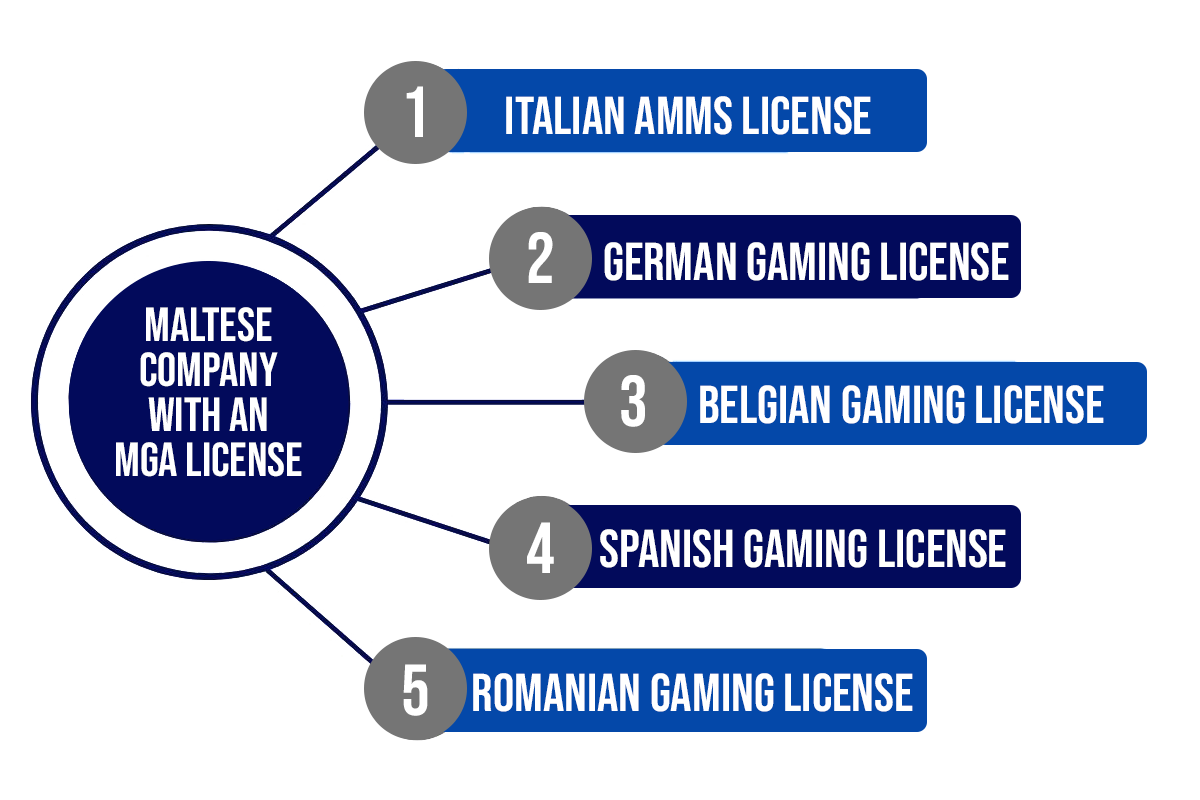

Flexibility in Europe

If you decide to focus on the European market and acquire multiple local licenses, a Maltese license is a good starting point. You can acquire all your licenses under the same Maltese company instead of setting up a separate company in each country.

Speed in Europe

If you want to acquire local licenses in Europe then each new license will be a breeze, as many procedures and regulations are the same in other EU countries with minor changes.

What are the requirements of a Maltese license?

You should establish substance for the purposes of tax planning

You will need a team of experienced professionals to qualify for the Malta betting license. Here is a complete list of all the positions you need to fill for the B2C license application.

CEO role

The person must have a minimum of three years of working experience in a managerial role and a related bachelor’s degree or higher, or a minimum of five years of working experience in a managerial role.

Management of the Operations

The person must have a minimum of two years of working experience in a managerial role and a related bachelor’s degree or higher, or a minimum of four years of working experience in a managerial role.

Compliance Operations Officer

The person must have a minimum of two years of working experience in a compliance-related role and a related bachelor’s degree or higher, or a minimum of four years of working experience in a compliance-related role.

Legal Affairs Officer

The person must have a minimum of two years of working experience in the role of legal counsel and/or in a similar senior role and a bachelor’s degree in law or higher.

Data Protection Officer

The person must have a minimum of two years of working experience in the role of data protection lead or data protection officer and a related diploma or certificate, or three years of working experience in the role of data protection lead or data protection officer.

AML / CFT officer

The person must have a minimum of two years of working experience as a money laundering reporting officer or similar senior and/or a related managerial role, and must be in possession of a related bachelor’s degree or money laundering specific qualification 1, or have four years working experience as a money laundering reporting officer or similar senior and/or related managerial role.

Technology Officer

The person must have a minimum of two years of working experience in a role related to IT and a related bachelor’s degree or higher, or four years working experience in an IT-related role.

Internal Audit Officer

The person must have a minimum of two years of working experience as an internal auditor or a similar role and be in possession of the relevant certificate to perform the role of internal auditor, or have four years of working experience as an internal auditor or similar role.

Application procedure

First Step – You must pass a “fit and proper” test

An MGA representative will evaluate the applicant and the owners of the business to determine if you can run such a business.

MGA will conduct 1-on-1 interviews to assess the experience of each key person.

Each applicant goes through an enhanced due diligence process with national and international law enforcement agencies.

Your identity and that of all the key people will be verified. To pass this check, the source of funds and a police clearance are required.

You can’t have a criminal record to pass a “fit and proper” test.

Second step – a financial and business assessment

Once MGA gets to know you and your team, they’ll conduct a financial and business assessment.

They want to know if you’ve the financial resources to run your business. Your business plan will be stress tested to make sure your resources fully match your ambitions

Your business plan is expected to provide a detailed financial forecast, including cash flow, profit and loss, balance sheet, marketing and sales strategies, HR and growth targets.

Step Three – Operational & Statutory Requirements

The MGA verifies that you’ve all the necessary tools to operate your business. They will check your incorporation documents, games, business processes related to conducting the games, rules, conditions, policies, procedures, and technical documentation of the gaming and control system.

Depending on the type of license, you may have to pay a share capital.

| Type | Amount |

|---|---|

| Type 1 | Minimum € 100.000 |

| Type 2 | Minimum € 100.000 |

| Type 3 | Minimum € 40.000 |

| Type 4 | Minimum € 40.000 |

Companies with multiple type approvals must meet the above requirements for share capital cumulatively, up to a maximum required capping of €240,000.

This is the key point, because if you can’t meet the requirements of the first three steps, your application will be dropped and you’ll have to reapply.

The few rejections I know of happened because the UBO wasn’t suitable for a “fit and proper” test.

Fourth Step – System review and compliance testing

The MGA checks to see if you’re in compliance and evaluates your current IT environment against the setup you described in your business plan and application.

Since both the application and the business plan passed the test long before this step, it’s important to check how things look in reality.

GLI Europe BV, iTechlabs, RSM Malta are one of the few approved system and compliance auditors.

You’ll have sixty days to complete the technical transition or your application will be dropped.

Step Five – Issuance of License

Upon successful completion of the certification process, the Authority issues a license for ten years.

An executive director and a secretary are the minimum must! Each of them must pass a KYC test.

Four different B2C licenses you can apply for:

Type 1 license

Games of chance played against the house with the outcome determined by a random number generator. This includes casino-like games such as roulette, blackjack, baccarat, poker against the house, lotteries, secondary lotteries and virtual sports games.

Type 2 license

Games of chance played against the house, the outcome of which is determined not by a random number generator, but by the outcome of an event or competition unrelated to a game of chance, and where the operator manages its own risk by controlling the odds offered to the player; Think about fixed odds betting, pool betting and spread betting.

Type 3 license

Games of chance that don’t involve playing against the house and where the operator doesn’t bear the risk of the game but earns revenue through a commission or other fee based on the stake or winnings; this includes games where players compete against players, such as poker, bingo, betting exchanges and other commission-based games;

Type 4 license

Controlled games of skill as defined in Regulation 8 of the Gaming Authorizations Regulations. For example, fantasy sports.

You can combine multiple licenses if you need to do so for your business model.

What countries are supported by the Maltese license?

It’s said that Malta Online Gaming License can be used in countries where there’s no legal ban on gambling or where a local license is available.

We’ve created a list of countries that you should avoid if you don’t want to have problems with the MGA.

What is the cost of the license?

The Maltese gambling license isn’t cheap. It’s like a private club where you’ve to pay to play.

It’s probably you’ll end up paying too much if someone tells you the final amount for the Malta online gambling license cost.

You have to pay incorporation fees, license fees, Professional fees, Audit associated fees.

Every business is different and your needs will be different from other Business Owners. We are helping to get a Maltese License in a shortest time possible. If you are looking for a tailor-made offer, get in touch with us through this application form.

All documents you will need for your Malta gambling license

- A police good conduct certificate dated no older than three months for each company owner and applicant

- Original bank references of all owners/applicants dated no older than three months

- Notarized copies of passports of all owners/applicants

- A detailed business plan

- A compliance and software audit

- Details of all gaming software used and third party agreements

Taxes on Malta

Business entities established in Malta are subject to tax at the standard rate of 35%.

Shareholders of companies registered in Malta are entitled to a tax refund upon the distribution of profits.

In general, the tax refund amounts to 6/7ths of the tax paid by the company resulting in a maximum effective tax rate of 5% after-tax refunds.

Taking as an example a company which makes taxable profits of €10,000

| Company tax | Value |

|---|---|

| Profit before tax | €10,000 |

| Tax at 35% | (€ 3,500) |

| Profit after tax | €6,500 |

For shareholders of companies registered in Malta

| Shareholder | Value |

|---|---|

| Refund on the distribution (6/7ths tax refund) | €3,000 |

| Effective rate of tax on profit before tax | 5% |

Annual license fees

Fixed Annual license fees for B2C operators

| Service | Fee |

|---|---|

| Non-refundable Fixed Annual License Fee | €25,000 |

| Non-refundable Fixed Annual License Fee for operators providing solely Type 4 gaming services | €10,000 |

Fixed Annual license fees for (B2B only)

| License Fee for providers supplying solely Type 1-3 gaming supplies | Fee |

|---|---|

| Where annual revenue does not exceed €5,000,000 | €25,000 |

| Where annual revenue exceeds €5,000,000 but does not exceed €10,000,000 | €30,000 |

| Where annual revenue exceeds €10,000,000 | €35,000 |

License Fee for providers supplying solely Type 4 gaming supplies

| License Fee for providers supplying solely Type 4 gaming supplies | Fee |

|---|---|

| Fixed Annual License Fee | €10,000 |

B2B – Critical Gaming Supply | Annual Licenses fees used (supply & management of software)

| B2B – Critical Gaming Supply | Annual Licenses fees used (supply & management of software) | Fee |

|---|---|

| Annual revenue does not exceed €1,000,000 | €3,000 |

| Annual revenue in excess of €1,000,000 | €5,000 |

Compliance contribution

| Compliance Contribution for the Financial Year* | Rate |

|---|---|

| For every euro of the first €3,000,000 | 1.25% |

| For every euro of the next €4,500,000 | 1.00% |

| For every euro of the next €5,000,000 | 0.85% |

| For every euro of the next €7,500,000 | 0.70% |

| For every euro of the next €10,000,000 | 0.55% |

| For every euro of the remainder | 0.40% |

| Compliance Contribution for the Financial Year* | Rate |

|---|---|

| For every euro of the first €3,000,000 | 4.00% |

| For every euro of the next €4,500,000 | 3.00% |

| For every euro of the next €5,000,000 | 2.00% |

| For every euro of the next €7,500,000 | 1.00% |

| For every euro of the next €10,000,000 | 0.80% |

| For every euro of the next €10,000,000 | 0.60% |

| For every euro of the remainder | 0.40% |

| Compliance Contribution for the Financial Year* | Rate |

|---|---|

| For every euro of the first €2,000,000 | 4.00% |

| For every euro of the next €3,000,000 | 3.00% |

| For every euro of the next €5,000,000 | 2.00% |

| For every euro of the next €5,000,000 | 1.00% |

| For every euro of the next €5,000,000 | 0.80% |

| For every euro of the next €10,000,000 | 0.60% |

| For every euro of the remainder | 0.40% |

| Compliance Contribution for the Financial Year* | Rate |

|---|---|

| For every euro of the first €2,000,000 | 0.50% |

| For every euro of the next €3,000,000 | 0.75% |

| For every euro of the next €5,000,000 | 1.00% |

| For every euro of the next €5,000,000 | 1.25% |

| For every euro of the next €5,000,000 | 1.50% |

| For every euro of the next €10,000,000 | 1.75% |

| For every euro of the remainder | 2.00% |

5% gaming tax

5% Gaming Tax is applied on Gaming Revenue generated from Malta based players. Determination of taxability is whether the player is established, has his permanent address and/or usually resides in Malta.

Comments(0)